DBA Use case definition

Back to Doing Business Abroad main page

[Final]

1 Partners

Austria

Federal Ministry for Digital and Economic Affairs (BMDW): The tasks of the Federal Ministry for Digital and Economic Affairs include the comprehensive offerings of the e-government sector, the overall coordination of e-government as well as the digital transformation of the economy and society in Austria. The tasks of the Ministry are performed by various Centres and Directorates General with differing priorities (Economic Policy, Innovation & Technology; External Trade Policy & European Integration, etc.).

The Austrian Federal Computing Centre (BRZ): The Austrian Federal Computing Centre (short: BRZ as abbreviated from the German name Bundesrechenzentrum) is the market-leading technology partner of the public sector in Austria. As such, BRZ has developed and implemented more than 400 IT applications and e-government solutions. BRZ also operates one of Austria’s largest data centres, guarding the country’s precious treasury of data.

Netherlands

Netherlands Enterprise Agency (RVO): RVO is the department of the Ministry of Economic Affairs and Climate Policy that participates in the DE4A project. This Agency encourages entrepreneurs in sustainable, agrarian, innovative and international business. It helps with grants, finding business partners, know-how and compliance with laws and regulations. The aim is to improve opportunities for entrepreneurs and strengthen their position. The activities of the Agency are commissioned by the various Dutch ministries and the European Union. The Netherlands Enterprise Agency focuses on providing services to entrepreneurs. It aims to make it easier to do business using smart organisation and digital communication. The Agency works in The Netherlands and abroad with governments, knowledge centres, international organisations and countless other partners.

Kamer van Koophandel (KVK): Netherlands Chamber of Commerce officially registers companies and gives them advice and support. The main task of the Chamber of Commerce is to keep the Commercial Register (the business register). In the Netherlands registration in the Commercial Register is compulsory for every company and almost every legal entity. This means that the register is able to provide reliable answers to such questions as: Does the company I want to do business with actually exist? Is the person I am dealing with actually an authorised signatory? What has happened to the company I used to do business with?

Sweden

Skatteverket (SKV): The main functions of the Swedish tax agency (Skatteverket) are: Taxes, Population registration and Estate inventories. Skatteverket is accountable to the government but operates as an autonomous public authority. This means that the government has no influence over the tax affairs of individuals or businesses.

Bolagsverket (BVE): The Swedish Companies Registration Office (Bolagsverket) creates the conditions needed for establishing trust within the business sector. BVE’s primary role is to register company information and make it available, which contributes value to society. BVE will provide good conditions for business. BVE wants to create a good infrastructure for growth and give enterprising individuals the indications they need for achieving their dreams. BVE is working with other government agencies in order to reach these goals. Bolagsverket registers new companies, changes in company information and annual reports. Persons can also search for and purchase company information from BVE’s registers. Working together with others, BVE helps to make life simpler for companies and those doing business.

The agency for digital government (DIGG): DIGG is a new government authority, created to think creatively, address new challenges and identify new opportunities, started in 2018. Several reports and inquiries have concluded that governance of digital administration is complex and overly fragmented. DIGG has collective responsibility for these issues in order to achieve more transparent governance toward the goals set by the central government. DIGG will serve as a hub for digitalization of the public sector.

Romania

CIO Office: The CIO Office is part of the General Secretariat of the Government (aka the Prime Minister’s Office). It coordinates the IT&C of the Romanian central public administration, establishes the architecture of the IT&C systems, oversees the investments in IT&C and cooperates in the field of cybersecurity with the other law enforcement, defence and intelligence agencies. The CIO Office will coordinate Romania’s participation in the pilot.

Oficiul National al Registrului Comertului (ONRC): The National Trade Register Office (short: ONRC/RO an NTRO/EN) is a public institution with legal personality, organized under the Ministry of Justice, financed entirely from the state budget through the Ministry of Justice. NTRO is organised with 42 local offices (county seat) without legal personality and works beside tribunals. NTRO's vision is to contribute to the development of the business environment in Romania by providing quality public services, flexible and geared to the specific needs of applicants. The main mission of the National Trade Register Office (NTRO) is in the public service of keeping the trade registry and to perform legal acts and facts advertising entrepreneurs, and performing the procedure for summoning and publicity of insolvency proceedings.

2 Pilot scenarios

- Pilot scenario DBA1: USP.gv.at: USP (Business service portal) includes several services (starting a business online) that are not restricted to Austrian companies. In order to qualify for the service, the company must provide the necessary data and needs an entry in one of the registers. The stored company data must be kept up to date. This scenario entails a non-Austrian company that applies for a service carried out by usp.gv.at. Currently, this is a semi-automated process, due to a necessary application process to identify organisation and the approval of the powers (of representation). In the pilot process, the company can apply for these services through an easy online form, which will trigger an automatic registration to most of Austria´s online services. Additionally, as best-effort, Austria will make this application process fully automated, so the company does not have to supply information to USP that is already known to a data provider in another Member State (the ‘native’ country of the business) in application of the Once-Only Principle. In either case, USP is able to retrieve this information from the data provider and keep the information up to date. The minimum goal of the scenario is to digitalise this process. The maximum goal is to implement a fully automated process.

- Pilot scenario DBA4: MijnRVO.nl: RVO offers several services for companies that are not restricted to Dutch companies. In order to qualify for the service, the company must provide the necessary data. Besides the specific data required to qualify for the service, RVO also requires general data of the company itself, for identification, communication and compliance purposes. RVO stores this company data in a central (‘customer’) registry that is used for most RVO services. The stored company data must be kept up to date. This scenario entails a non-Dutch company that applies for a service carried out by RVO.nl. In this process, the company does not have to supply information to RVO that is already known to the data provider in a Member State (the ‘native’ country of the business) in application of the Once-Only Principle. RVO.nl is able to retrieve this information from the data provider and keep the information up to date.

- Pilot scenario DBA5: Verksamt.se (PSC): Companies that want to do business in Sweden will be registered by the Swedish Companies Registration Office through the Swedish Point of Single Contact Verksamt.se. The portal presents companies with information and e-services. There is no information stored within the portal. The source of company information will be the respective authority. There is an opportunity to do a tax registration, with underlying processes such as registering the company at Skatteverket, registering as an employer, paying VAT, applying for F-tax and so on. It is also possible to register a branch of a foreign company, by using the service provided by Bolagsverket. Verksamt.se is designed to provide a unified process for the foreign company to be able to register a branch and then make a tax registration in Sweden, depending on how the company intends to conduct business operations in Sweden. Verksamt.se also supports foreign companies, whether they conduct business from a permanent establishment in Sweden or only want to register for tax purpose (not register a branch), for selected processes e.g. to register as an employer or F-tax. F-tax can be applied for without liability to pay income tax, but serves as a proof that the company has no tax liabilities in the country of registration and is therefore considered serious.

- Pilot scenario DBA6: eService Layer at portal.onrc.ro: Companies wishing to do business in Romania will be registered by the National Trade Register Office. The registration of the company of a single trader, company or branch of a foreign company is done using the online service portal eService Layer at portal.onrc.ro and leads to the registration in the register of Romanian companies (ONRC). The registration also leads to registration with the Romanian tax agency - ANAF. As part of the registration with the tax agency, the company can (if applicable) register the permanent unit and register for VAT.

3 Use cases

- Use case 1: Starting a business in another Member State. At the core of this use case is the fulfilment of procedural obligations to do business in another Member State, especially the initial registration of a company at an eProcedure portal (AT, NL and RO pilot scenarios), opening a branch and the assessment of tax duties in the destination Member State (in the Swedish pilot scenario). In this use case, a company representative authenticates to the eProcedure portal, registers the company at the portal and applies for a service.

- Use case 2: Doing business in another Member State. This use case focusses at assessing the consequence for active eServices in case of a business event, e.g. company goes bankrupt, company stops it’s activities, company merges, etc. The data consumer may subscribe to notifications on selected business events. In case such an event occurs, the data provider notifies the data consumer. The data consumer needs to assess the relevance of the notification. It can then for example request the updated data from the data provider or decide it doesn’t need any additional data. Furthermore, the data consumer may intervene in an active eService (e.g. stop periodical grants or impose a tax obligation). The data consumer may also use the notifications as input to a general fraud prevention and protection procedure.

| Pilot scenario # | Pilot scenario short name | Use case to pilot | |

| UC1: starting a business in another Member State | UC2: Doing business in another Member State | ||

| DBA1 | USP.gv.at | x | x |

| DBA4 | MijnRVO.nl | x | x |

| DBA5 | Verksamt.se (PSC) | x | x |

| DBA6 | eService Layer at portal.onrc.ro | x | x |

4 Interaction patterns

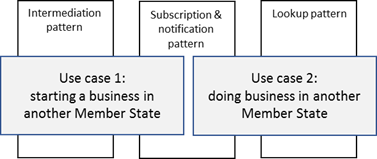

The use cases implement three interaction patterns:

- The intermediation pattern: for fetching company data at the request of the user from the business register directly.

- The subscription and notification pattern: for allowing data consumers to subscribe to updates on company data and to receive notifications of changes in company data.

- The lookup pattern: for providing a light weight alternative to the intermediation pattern for fetching (possibly updated) company data from business registers with direct service calls. This pattern focusses on high frequency, highly standardised data requests to data sources which the data consumer is familiar to.

The diagram below shows the mapping of the use cases to the interaction patterns.